Analyzing trading performance is one of the most effective ways to enhance your Forex trading strategy. Performance reports provide valuable insights into your strengths, weaknesses, and overall trading behavior. In this article, we’ll explore how to use trading performance reports to identify areas for improvement and refine your strategy for better results.

1. Understand the Key Metrics in Performance Reports

Trading performance reports often include key metrics that reflect your trading behavior and results.

Some of the most important metrics to focus on include:

- Win Rate: The percentage of trades that were profitable.

- Risk-to-Reward Ratio: How much you gained compared to how much you risked.

- Average Trade Duration: The time you held your trades.

Pro Tip:

Focus on understanding each metric and how it relates to your overall trading performance.

2. Identify Patterns in Your Trades

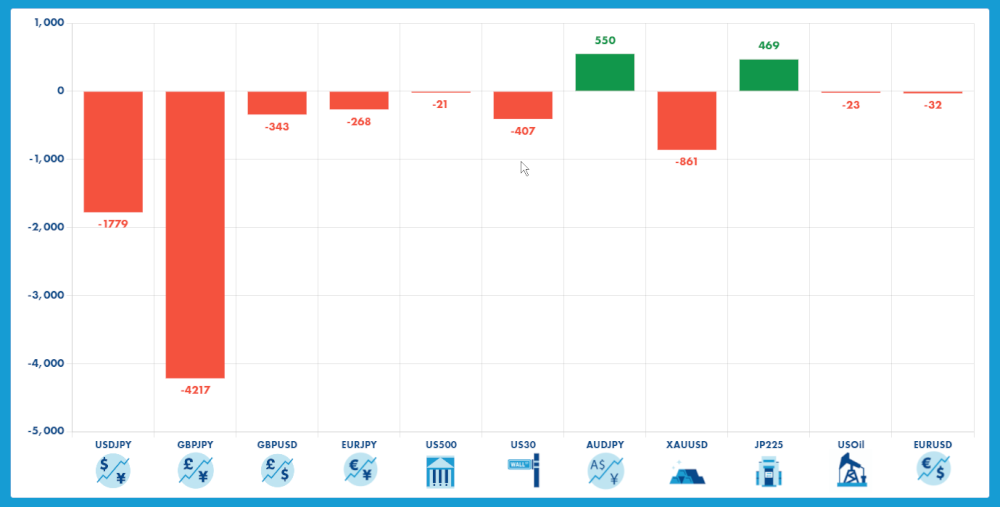

Performance reports can reveal recurring patterns in your trades, such as:

- Winning more often during specific market conditions (e.g., trends or ranges).

- Consistently losing on certain currency pairs.

- Overtrading after a losing streak.

Why It Matters:

Recognizing these patterns allows you to double down on strategies that work and avoid behaviors that lead to losses.

3. Evaluate Your Risk Management

Performance reports provide valuable insights into your risk management practices. For example:

- Are you risking too much on individual trades?

- Are your stop-loss levels too tight or too wide?

- Are you achieving a favorable risk-to-reward ratio?

Pro Tip:

Use your reports to adjust your position sizing and refine your stop-loss strategies.

4. Adjust Your Strategy Based on Performance Trends

Your performance trends over time can indicate whether your current strategy is effective. For example:

- Are you consistently profitable in trending markets but struggling in range-bound markets?

- Are your results improving or declining over the past months?

- Do specific trading sessions (e.g., London or New York) yield better results?

Key Insight:

Modify your strategy to align with the conditions where you perform best while addressing areas where you struggle.

5. Set Realistic Goals for Improvement

Performance reports can help you set specific, measurable, and achievable goals. For instance:

- Increase your win-to-loss ratio by 5% over the next month.

- Reduce your average drawdown by improving your stop-loss placement.

- Focus on trading only during your most profitable market conditions.

Pro Tip:

Regularly review your progress toward these goals using updated performance reports.

6. Gain Confidence in Your Strategy

Reviewing your performance helps you build confidence in your trading strategy. By understanding its strengths and addressing its weaknesses, you’ll be more prepared to stick to your plan, even during challenging market conditions.

7. Avoid Repeating Mistakes

One of the greatest benefits of performance analysis is that it helps you identify and avoid repeating mistakes. By documenting your errors and the lessons learned, you can continuously improve your approach.

Take Action Today

Start using trading performance reports to analyze your past trades and refine your strategy. Regularly reviewing your performance will not only help you identify areas for improvement but also build the confidence needed to succeed in Forex trading.