Historical data is a treasure trove for traders, offering valuable insights into past market behavior. By studying and analyzing historical price movements, traders can develop strategies based on proven patterns, test ideas without financial risk, and refine their skills for live trading. This article explores the critical role of historical data in crafting winning trading strategies.

1. Identifying Market Patterns and Trends

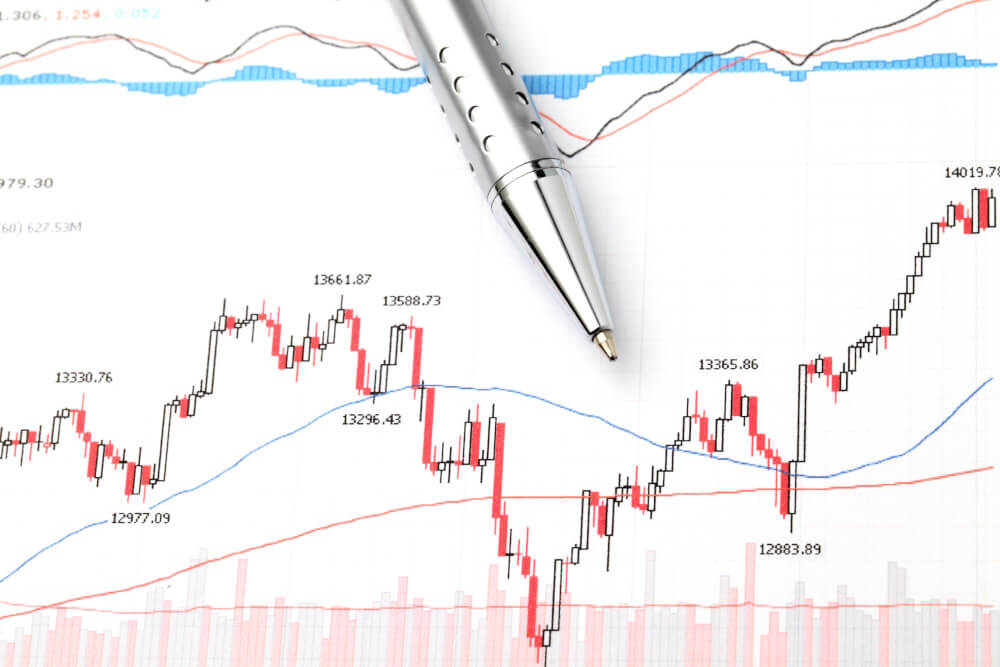

Historical data allows traders to identify recurring market patterns, such as head-and-shoulders formations, double bottoms, and trend reversals. By recognizing these patterns, traders can develop strategies to capitalize on predictable price movements.

2. Backtesting Strategies Without Financial Risk

One of the greatest advantages of historical data is the ability to backtest trading strategies. Traders can simulate how their strategy would have performed in the past, identify weaknesses, and refine their approach—all without risking real money.

3. Understanding Market Volatility and Risk

Analyzing historical data helps traders gauge the volatility of specific currency pairs or markets. By understanding past fluctuations, traders can set realistic expectations for risk and adjust their position sizes and stop-loss levels accordingly.

4. Testing Strategies in Different Market Conditions

Markets can shift between trending, range-bound, and volatile conditions. Historical data enables traders to test their strategies across different scenarios to ensure they are robust and adaptable.

5. Refining Entry and Exit Points

Historical price data allows traders to identify optimal entry and exit points by studying past reactions to key levels, such as support, resistance, and Fibonacci retracements. This helps improve timing and maximize profits.

6. Enhancing Confidence Before Live Trading

By testing strategies on historical data, traders can gain confidence in their approach. Knowing that a strategy has worked in the past gives traders the assurance they need to execute trades effectively in live markets.

7. Learning from Past Mistakes

Historical data isn’t just about finding opportunities—it’s also a tool for learning. By reviewing past trades and market behavior, traders can identify mistakes and ensure they don’t repeat them in the future.

The Power of Historical Data

Historical data is a foundational tool for any trader seeking long-term success. It enables you to test strategies, refine your approach, and gain insights that can’t be learned from live trading alone. By leveraging historical data, you can develop a winning trading strategy that stands the test of time.